The Best Strategy To Use For Simply Solar Illinois

Table of ContentsHow Simply Solar Illinois can Save You Time, Stress, and Money.The Definitive Guide to Simply Solar IllinoisWhat Does Simply Solar Illinois Do?Indicators on Simply Solar Illinois You Need To KnowThe 7-Second Trick For Simply Solar Illinois

Simply put, your financial savings with a solar panel system are equivalent to what you would have paid for utility electrical power minus the quantity you spent for the setup and upkeep of the system. In practice, nevertheless, this is a tricky estimation since a whole lot depends upon exactly how you pay for electrical energy at the moment and because you generally spend for the system simultaneously upon setup.

This indicates that rather than offsetting the expensive price of height electrical energy manufacturing, homeowners' solar power systems simply offset the cost they are billed for power, which is a lot closer to the ordinary expense of power manufacturing. Lots of energy business in the United state have introduced rates schemes that enable property owners to be charged at different prices throughout the day to mirror the actual cost of electricity production at various times.

A PV solar array might be helpful in areas where this time-variable rate is utilized, because the solar energy created would offset the most costly electrical energy. Exactly just how helpful this is for a given property owner depends on the timing and size of the rate modifications under such a strategy. Similarly, energies in some areas have pricing plans that vary over different times of the year as a result of routine seasonal demand changes.

Other homeowners may need to wait 10 or 15 years. To put it simply, the majority of house owners will eventually see a take advantage of a solar energy system; it could just take years for this to be understood. Whether it deserves installing such a system, consequently, usually comes down to a number of a lot less technical factors than those we've detailed above: how much time you are going to stay in your home, the subsidies offered in your location, and simply whether you want to do your little bit for the atmosphere.

Simply Solar Illinois Things To Know Before You Buy

Most homes will certainly discover that the savings from photovoltaic panels will certainly exceed the costs, although it may take anywhere from a few years to decades to achieve. Planetary system are costly to mount however need little maintenance over a lifespan of 20 to thirty years. Property owners ought to think about the quantity of cash they have to invest in solar, whether financing options are available, the advantages they may receive in regards to subsidies or tax credit reports, and how much time they plan to remain in their homes.

Determining whether to install a PV solar system may seem difficult, but it is very important to bear in mind that such a system is a long-term financial investment. Solar energy is a good selection in several locations from a financial viewpoint. Solar energy usually sets you back a lot upfront at the time of setup, which can be too high for some home owners.

Solar panels produce no air pollution, although they impose ecological expenses through manufacture and building. These environmental tolls are negligible, nevertheless, when compared with the damage caused by conventional energy resources: the burning of nonrenewable fuel sources releases approximately 21 (IL Solar Company).3 billion statistics loads of co2 into the atmosphere each year. Solar energy is suitable for remote locations that are not linked to energy grids

The Ultimate Guide To Simply Solar Illinois

Individuals in these areas need to count on fuel-based lights, which causes significant social and ecological costs, from endangered health and wellness via contamination of interior air, to restricted overall efficiency. Solar power offers green jobs. Manufacturing of photovoltaic panels for residential use is coming to be an expanding source of work in study, manufacture, sales and installment.

In the long run, solar check it out power is cost-effective. Solar panels and installation include high first expenses, but this price is soon balanced out by financial savings on energy expenses.

In some situations, your photovoltaic panels might produce even more power than you utilize. This excess energy is normally saved in solar batteries for later usage or can go back to the major power grid (illinois solar companies). Solar tools like electrical lorry (EV) billing terminals and solar carports can additionally be incorporated with your planetary system to power your electric automobiles

Simply Solar Illinois Can Be Fun For Everyone

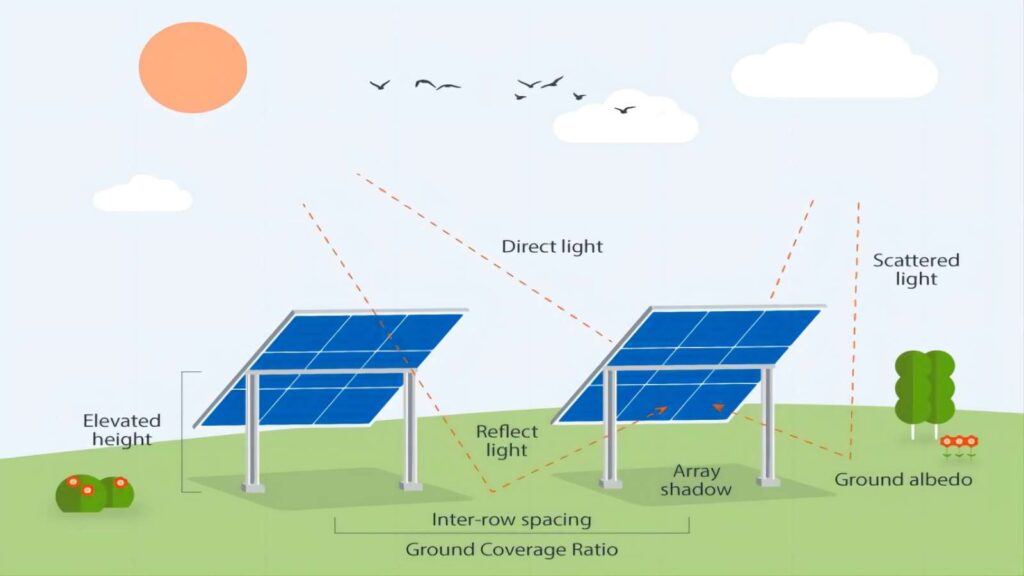

They are made up of solar (PV) cells, which catch sunlight. The cells are bordered by a sturdy metal frame and special glass casing, forming a panel. Solar panels are normally organized in a bought collection called a variety and positioned on roofs or various other huge outdoor areas. There are numerous steps to power generation with a solar PV system.

As these electrons relocate with the electrical field, they generate an electrical existing. The electrical current created by the communication in between sunshine and PV cells is recognized as direct present (DC) electricity.

(https://sitereport.netcraft.com/?url=https://simplysolarillinois.com)Need convincing?

All about Simply Solar Illinois

According to some estimates, the average solar system conserves customers even more than $20,000 over twenty years. In some locations, the financial savings can rise to $64,000. Even if you aren't convinced of the benefits of solar power yet, the USA federal government is. Actually, the government uses a 30% government solar tax credit history to both residential and industrial residential or commercial properties, and several state governments provide additional tax credits also.